Digital Adoption: Trends & Opportunities In A Post-pandemic Landscape by Subhabrata Dasgupta on October 14, 2021 1,989 views

An increased thrust on digital adoption is one of the most important and enduring legacies of the unprecedented COVID-19 pandemic. Cutting across industries — from Healthcare to Financial Services to Manufacturing — companies revisited their operations, customer interactions, and employee collaborations, with a special focus on digital.

With their nimble responses, companies — cutting across sectors and regions — advanced their digital adoption by several years. A global survey1 of 800+ C-level executives & senior managers found that companies have quickened the digitization of customer interactions, supply-chain interactions, and internal operations by 3-4 years. The survey represented different regions, specialties, sizes and industries.

The speed with which companies developed products and services that are digital/digitally enhanced has been remarkable. The survey findings report an average seven-year increase in the rate of development of such products and services. Moreover, this speed is heightened even further to 10 years in developed Asia.

There is evidence to suggest that this move towards digital adoption may not be temporary. For example, let’s consider two industries that saw a surge in digital adoption in response to the pandemic.

Healthcare

Consider the healthcare industry in the US. A McKinsey analysis2 shows that overall telehealth utilization was 78 times higher in April 2020 (compared to the pre-COVID levels of February 2020).

This utilization has since stabilized at 38 times higher in February 2021 (vs. February 2020 levels). As per the same analysis, the factors responsible for the continued growth of telehealth in 2021 are continued strong adoption, positive consumer sentiments, favorable regulatory changes and substantial investment.

Healthcare delivery and its underlying business models are further evolving to accommodate a virtual component. This evolution manifests in a range of ways like hybrid care and telehealth integration with different virtual healthcare solutions, to name some. Potential opportunity areas are in the improvement of consumer experience, growing access to the unserviced/underserviced, boosting health outcomes, and in innovations that improve affordability.

Education & Training

Further, in education and training, the COVID-19 pandemic has provided an added impetus to digital adoption measures at every level.

The Pre-K segment has witnessed a growth in demand from parents who seek technology-aided activities and educational tools for children.

In the K-12 segment, schools have had to embrace technology adoption to fulfill various needs in operations, learner support, and communications with parents.

The Higher Education and post-secondary landscape have witnessed an immediate and abrupt transition to online delivery. The same can be said of workforces that have sought online delivery alternatives for up-skilling and employee engagement purposes.

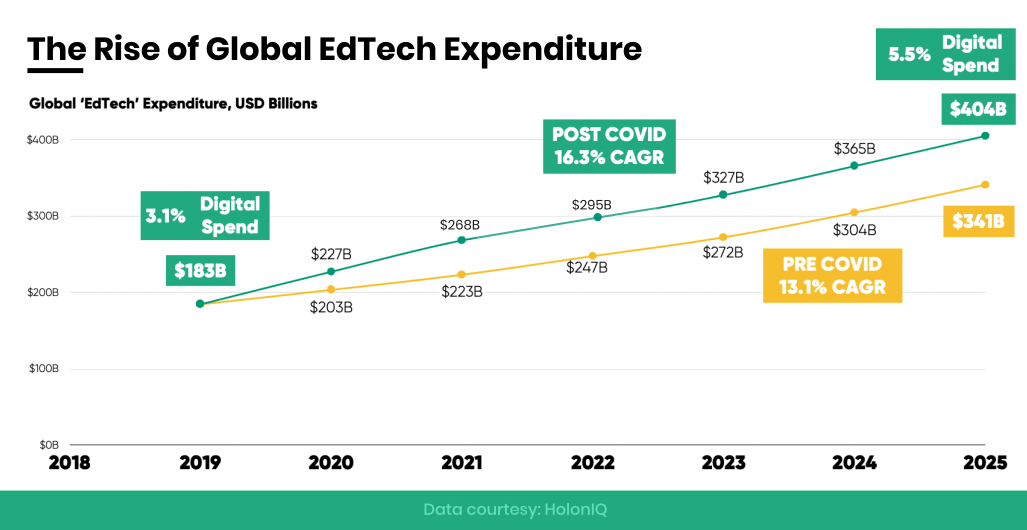

Global EdTech expenditure is expected to reach $404B by 2025 — an upgrade of $63B from pre-COVID estimates3. Compared to 2019-level expenditures, this represents 2.5X growth. But, notably, even at this level, digital expenditure in education will only constitute 5.5% of the $7.3T global education market by 2025.

HolonIQ, a market intelligence platform that tracks developments in global education, throws light on future opportunities. The findings show a significant gap in the digital infrastructures necessary to facilitate learning, data, and administration. In the coming years, education providers will seek to close this gap further to smoothen digital adoption, consistent with consumer technology expectations.

Long-held Assumptions About Digital Adoption Shattered

The unprecedented crisis and the business responses to it have shattered longstanding assumptions4 about digital transformation.

For instance, consider the pre-pandemic assumptions about customers preferring the human touch over digital experiences. In contrast, the last two years’ experience has shown that a well-thought-through digital experience could be equally significant. In some cases, that experience could even prove to be more personalized compared to physical customer engagement. Again, well-documented examples could be drawn from a host of industries like banking, education and training, healthcare and more.

Further, the agility of regulatory frameworks to facilitate digital adoption and transformation has shattered previously held notions. The recent experience has shown how highly regulated industries (for example, healthcare in the US) can address contentious issues (like privacy and reimbursements) in collaboration with government stakeholders.

What’s Next For Digital Adoption?

Increasing vaccination coverage across the world has seen an abatement in the risk of infection and hospitalization events. Remote work has seen a gradual shift to hybrid models and eventual plans for a phased return to physical offices. In the midst of all this, where does digital adoption fit?

Recent findings5 indicate that total digital adoption stays above pre-pandemic levels, despite plateauing growth after the remarkable initial surge.

The key lies in improving digital experiences, investing in ‘phygital’— a seamless blend of digital and physical experiences, and winning customers’ trust with a human-centered, easy-to-use digital approach. (The term ‘phygital’ was coined and trademarked by Australia-based agency Momentum).

At Argusoft, we have been following developments in this space with a keen eye. Using our two decades of experience and solution design prowess, we are specifically equipped to develop human-centered digital experiences that align with pointed consumer expectations and industry trends in a post-pandemic environment. Low-code iBPMS solutions with configurable modules, like our Business Modeller (BM) assume even greater significance. BM is industry-agnostic, robust, customizable and highly scalable, allowing for near-instant Go To Market strategies.

We continue to be trusted for our high-quality software solutions by our clients in governments, UN organizations, Fortune 1000 companies, and more.

Explore post-pandemic digital transformation opportunities in your industry with Argusoft.

References:

- https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/how-covid-19-has-pushed-companies-over-the-technology-tipping-point-and-transformed-business-forever

- https://www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

- https://www.holoniq.com/notes/sizing-the-global-edtech-market/

- https://mitsloan.mit.edu/ideas-made-to-matter/digital-transformation-after-pandemic

- https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/whats-next-for-digital-consumers